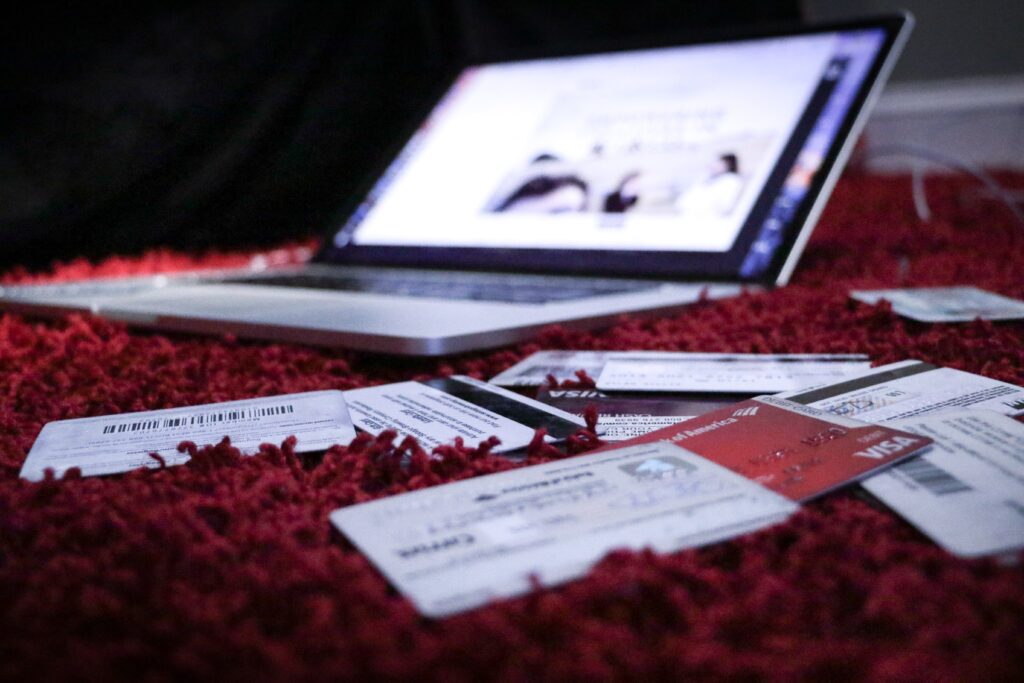

In this illuminating article, we unravel the mysteries surrounding the relationship between credit cards and your credit score. Prepare to have your preconceived notions challenged as we differentiate between common myths and the undeniable facts. Understanding the true impact of credit cards on your credit score is essential in navigating the world of personal finance, and we’re here to debunk any misconceptions along the way. So, sit back, relax, and let’s shed some light on this intriguing topic together.

Myth 1: Closing a Credit Card Will Improve Your Credit Score

Explanation of the myth

One common misconception about credit cards is that closing an unused or unwanted card will automatically boost your credit score. The thinking behind this myth is that by eliminating a credit card, you are reducing the overall amount of credit available to you, which may make you appear less risky to lenders. However, this belief is not accurate and can lead to confusion when it comes to managing your credit.

Fact: How closing a credit card affects your credit score

In reality, closing a credit card can actually have a negative impact on your credit score. This is because several factors contribute to your credit score, including your credit utilization ratio and the length of your credit history. When you close a credit card, you are essentially reducing the total credit available to you, which can increase your overall credit utilization ratio. This ratio is calculated by dividing your credit card balances by your total credit limits, and a higher ratio can indicate higher risk to lenders. Additionally, closing a credit card can also shorten the average age of your credit accounts, which may have a negative impact on your credit score. Therefore, it’s important to carefully consider the consequences before deciding to close a credit card.

Myth 2: Carrying a Balance on Your Credit Card Boosts Your Credit Score

Explanation of the myth

Another common myth surrounding credit cards is the belief that carrying a balance on your credit card will have a positive impact on your credit score. This misconception might stem from the idea that by accruing interest and making regular payments, you demonstrate responsible credit usage. However, this belief is not supported by the facts.

Fact: How carrying a balance affects your credit score

Contrary to the myth, carrying a balance on your credit card does not actually boost your credit score. In fact, carrying a balance can have the opposite effect. Your credit utilization ratio, which measures the percentage of your available credit that you are currently using, is an important factor in determining your credit score. Carrying a high balance on your credit card can increase your credit utilization ratio, which may reflect negatively on your creditworthiness. Instead, it is recommended to pay off your credit card balances in full each month to maintain a healthy credit score.

Myth 3: Having Multiple Credit Cards Will Hurt Your Credit Score

Explanation of the myth

It is often believed that having multiple credit cards can harm your credit score. The reasoning behind this myth might be that having access to a large amount of credit could lead to irresponsible borrowing and a higher risk for lenders. However, this belief is not entirely accurate.

Fact: How multiple credit cards impact your credit score

Having multiple credit cards does not necessarily hurt your credit score. In fact, it can have potential benefits when managed responsibly. One factor that contributes to your credit score is your credit mix, which considers the different types of credit accounts you have. By having a mix of different credit cards, such as a rewards card, a travel card, and a cashback card, you can demonstrate that you can handle different types of credit responsibly. However, it’s important to note that having too many credit cards could also potentially lead to overspending and financial trouble. It’s crucial to use your credit cards wisely, make timely payments, and keep your credit utilization ratio low to maintain a healthy credit score.

Myth 4: Paying Off Your Credit Card in Full Will Lower Your Credit Score

Explanation of the myth

Some people believe that paying off their credit card balances in full each month will result in a lower credit score. This misconception might stem from the idea that by not carrying a balance or accruing interest, there is less evidence of responsible credit usage. However, this belief is far from the truth.

Fact: How paying off credit cards affects your credit score

Paying off your credit card balances in full every month is actually a responsible and financially savvy move that does not lower your credit score. The main factor that influences your credit score is your payment history, which includes whether you make your payments on time. By consistently paying off your credit card balances in full and on time, you are demonstrating responsible credit behavior and improving your creditworthiness. It is important to remember that having a history of on-time payments and responsible credit usage is beneficial for your credit score.

Myth 5: You Need to Carry Debt on Your Credit Cards for a Good Credit Score

Explanation of the myth

There is a common misconception that in order to have a good credit score, you need to carry debt on your credit cards. This belief might stem from the notion that having some outstanding debt showcases your ability to handle credit responsibly. However, this belief is not accurate and can lead to unnecessary interest charges.

Fact: How debt utilization affects your credit score

Contrary to the myth, carrying debt on your credit cards is not a requirement for a good credit score. In fact, it is recommended to keep your credit card balances low or, ideally, at zero. The reason for this is your credit utilization ratio, which compares your credit card balances to your credit limits. A high credit utilization ratio can indicate higher risk to lenders and negatively impact your credit score. It is best to pay off your credit card balances in full and avoid unnecessary interest charges. Responsible credit card usage, such as making on-time payments and keeping low balances, is more important for a good credit score than carrying unnecessary debt.

Myth 6: Canceling Old and Inactive Credit Cards Will Improve Your Credit Score

Explanation of the myth

Some individuals believe that canceling old and inactive credit cards will have a positive impact on their credit score. The belief behind this myth might be that by eliminating unused credit, you reduce the risk of potential fraud or identity theft. However, this belief is not entirely accurate and can actually harm your credit score.

Fact: How canceling old and inactive cards affects your credit score

Canceling old and inactive credit cards can potentially lower your credit score, especially if those cards have a long credit history. The length of your credit history is an important factor in determining your credit score, and canceling an old credit card can shorten the average age of your credit accounts. Additionally, canceling a credit card may also affect your credit utilization ratio, especially if it had a high credit limit. It’s important to carefully evaluate the consequences before canceling a credit card. Instead of closing old and inactive cards, it’s often recommended to keep them open, especially if they have no annual fees, as they can contribute positively to your credit history and credit utilization ratio.

Myth 7: Your Credit Score is Negatively Impacted by Having Too Many Credit Inquiries

Explanation of the myth

There is a common belief that having too many credit inquiries can significantly lower your credit score. This myth might stem from the idea that multiple credit inquiries indicate a high level of borrowing or desperation for credit. However, this belief is not entirely accurate and can create unnecessary fear.

Fact: How credit inquiries affect your credit score

While credit inquiries do have an impact on your credit score, the effect is generally minimal. There are two types of credit inquiries: hard inquiries and soft inquiries. Hard inquiries occur when you apply for credit, such as a credit card or a loan, and can potentially affect your credit score. However, the impact of a single hard inquiry is usually minor and temporary. On the other hand, soft inquiries, which occur when you check your own credit or when a potential lender pre-screens you for a promotional offer, do not impact your credit score. Therefore, it’s important to be mindful of applying for excessive credit, but a few inquiries within a reasonable timeframe are unlikely to significantly harm your credit score.

Myth 8: Applying for Multiple Credit Cards at Once Will Severely Damage Your Credit Score

Explanation of the myth

A common misconception is that applying for multiple credit cards simultaneously will have a severe negative impact on your credit score. This belief might stem from the fear that multiple credit applications in a short period of time indicate financial instability or a high level of borrowing. However, this belief is often exaggerated and does not reflect the actual impact on your credit score.

Fact: How applying for multiple credit cards affects your credit score

While applying for multiple credit cards in a short period of time can have a temporary impact on your credit score, the effect is typically minor and short-lived. When you apply for credit, a hard inquiry is generated, which can slightly lower your credit score. However, the impact of a single hard inquiry is usually small and diminishes over time. The credit scoring models take into account the shopping behavior of consumers for credit-related products, such as mortgages or auto loans, and group multiple inquiries within a certain time frame (usually around 14-45 days) as a single inquiry. Therefore, as long as you apply for credit within a reasonable timeframe, the impact on your credit score should be minimal.

Myth 9: Retail Store Credit Cards Are Bad for Your Credit Score

Explanation of the myth

Retail store credit cards are often viewed with skepticism, and there is a prevailing myth that opening a retail store credit card will have a negative impact on your credit score. This belief might stem from the perception that retail store credit cards are less reputable or offer fewer benefits compared to traditional credit cards. However, this belief is not entirely accurate and can overlook the potential advantages of retail store credit cards.

Fact: How retail store credit cards impact your credit score

Contrary to the myth, retail store credit cards do not inherently harm your credit score. Like any other credit card, retail store credit cards can contribute positively to your credit score if managed responsibly. These cards often come with special promotions, discounts, and rewards programs that can be beneficial for frequent shoppers. Opening a retail store credit card can increase your available credit and potentially improve your credit utilization ratio, as long as you use the card responsibly and make timely payments. It is important to carefully evaluate the terms and conditions of the card, such as interest rates and fees, before applying for a retail store credit card. By using the card responsibly and paying off your balances in full each month, a retail store credit card can enhance your credit score.

Myth 10: Closing Credit Cards with Zero Balances Doesn’t Impact Your Credit Score

Explanation of the myth

It is commonly believed that closing credit cards with zero balances has no impact on your credit score. This belief might stem from the assumption that since there is no outstanding debt associated with the card, it should not affect your creditworthiness. However, this belief is not entirely accurate and can lead to unexpected consequences.

Fact: How closing credit cards with zero balances affects your credit score

Closing credit cards with zero balances can actually have a negative impact on your credit score, albeit a minor one. As mentioned earlier, a significant factor in determining your credit score is your credit utilization ratio. By closing a credit card, you are reducing your available credit, which can increase your credit utilization ratio if you carry balances on your other credit cards. Additionally, closing a credit card can also decrease the average age of your credit accounts, which may negatively impact your credit score. While the impact of closing a credit card with a zero balance is usually small, it’s important to be aware of the potential consequences and carefully evaluate the need to close the card. If the card has no annual fee, it is often recommended to keep it open to maintain a healthy credit history and credit utilization ratio.

In conclusion, it is important to be aware of the myths surrounding credit cards and their impact on your credit score. While certain beliefs may seem logical or intuitive, they are often misleading and can lead to financial misunderstandings. By understanding the facts and realities behind these myths, you can make informed decisions about managing your credit cards and maintaining a healthy credit score. Remember to pay your credit card balances on time, keep your credit utilization ratio low, and use credit responsibly to maximize the benefits of credit cards while safeguarding your financial well-being.