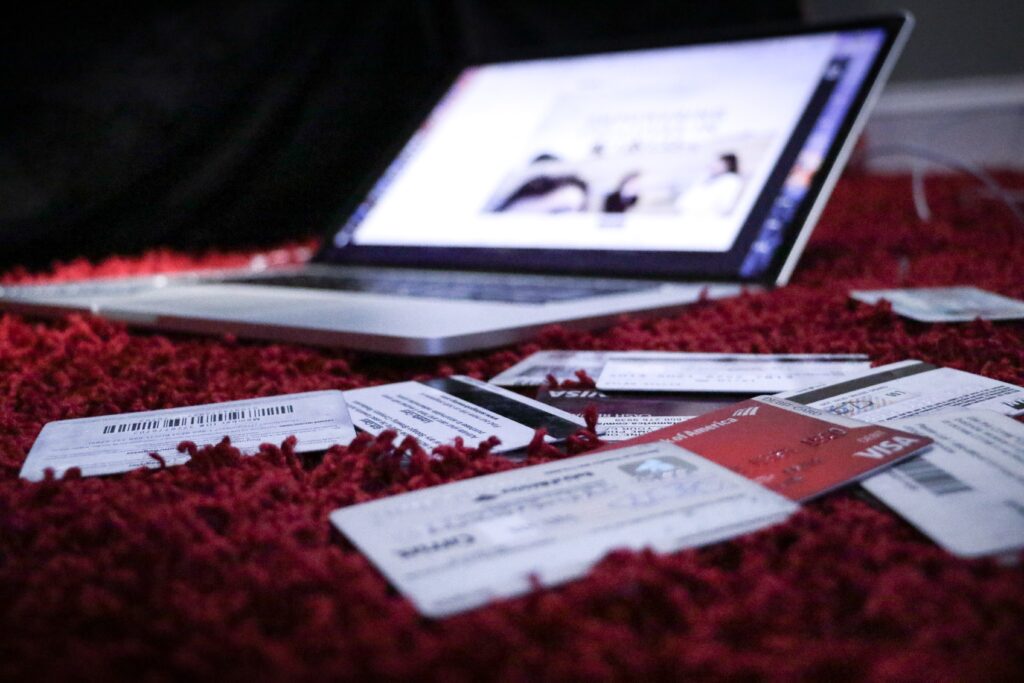

Have you ever wondered how credit cards work and what they can do for you? Look no further! “A Beginner’s Guide to Understanding Credit Cards” is here to help you navigate the world of credit cards with ease. From the basics of what credit cards are to understanding interest rates and building credit, this comprehensive guide will equip you with the knowledge you need to make informed decisions when it comes to managing your finances. So, whether you’re just starting out or looking to brush up on your credit card know-how, this guide is here to support you every step of the way.

What is a Credit Card?

Definition

A credit card is a financial tool that allows you to borrow money from a bank or credit card company to make purchases. It is a plastic card with a magnetic strip or chip that contains your personal information and provides access to a line of credit. Unlike a debit card, which deducts funds directly from your bank account, a credit card allows you to pay for goods and services on credit. Each credit card comes with a unique 16-digit card number, an expiration date, and a security code to ensure safe transactions.

How does it work?

When you make a purchase using your credit card, the card issuer pays the merchant on your behalf. Instead of using your own money, you accumulate a debt with the credit card company. At the end of each billing cycle, you receive a statement detailing your purchases and the amount owed. You have the option to pay the full balance or a minimum payment by the due date. If you choose to pay only the minimum, interest charges will be applied to the remaining balance. Any unpaid balance will carry over to the next billing cycle, accruing more interest.

Types of credit cards

There are various types of credit cards available, each designed to suit different needs and preferences. The most common types include:

-

Reward Cards: These credit cards offer rewards and perks for every purchase you make. Rewards can include cashback, travel points, airline miles, discounts, or gift cards. They are ideal for individuals who regularly use their credit card and want to maximize their benefits.

-

Student Cards: Designed for college or university students, these credit cards help students build credit history. They usually have lower credit limits and tailored rewards, such as cashback on textbooks or transportation expenses.

-

Secured Cards: Secured credit cards require a cash deposit as collateral, which serves as your credit limit. These cards are beneficial for individuals with no credit history or a low credit score, as they provide an opportunity to build creditworthiness.

-

Balance Transfer Cards: These cards allow you to transfer your outstanding balances from other credit cards onto a single card with a lower interest rate. They can help consolidate debt and save on interest charges.

-

Business Cards: Business owners can benefit from credit cards specifically designed for their needs. These cards often offer rewards on business-related expenses and provide tools to manage company spending.

Benefits of Owning a Credit Card

Convenience

Owning a credit card offers a range of conveniences. With a credit card in your wallet, you no longer need to carry large amounts of cash or visit an ATM frequently. Credit cards are widely accepted both online and in brick-and-mortar stores, allowing you to make purchases or pay bills conveniently. Furthermore, credit cards offer the flexibility of making purchases now and paying for them later, which can be particularly useful for unexpected expenses or emergencies.

Building Credit History

A credit card plays a crucial role in establishing and building your credit history. Responsible use, such as making timely payments and keeping your balances low, demonstrates to lenders that you are a reliable borrower. This, in turn, helps you build a positive credit score, which is essential when applying for loans, a mortgage, or even renting an apartment. By using a credit card responsibly, you can establish a solid credit foundation that opens up opportunities for future financial endeavors.

Rewards and Perks

One of the most appealing aspects of owning a credit card is the range of rewards and perks that come with it. Many credit cards offer a variety of rewards programs, such as cashback, points, or miles. Depending on the card and the rewards program, you can earn a percentage of your purchases back as cash or accumulate points to redeem for travel, merchandise, or gift cards. Some credit cards also provide additional perks like travel insurance, extended warranties, or access to exclusive events or airport lounges. These rewards and perks can add significant value to your overall credit card experience.

Understanding Credit Card Terms

Credit Limit

The credit limit is the maximum amount of money you can borrow using your credit card. It represents the total limit set by the credit card company, based on factors such as your income, creditworthiness, and credit history. It is crucial to stay within your credit limit to avoid over-limit fees and potential negative impacts on your credit score. Higher credit limits can provide greater purchasing power, but it is important to use credit responsibly and only spend what you can comfortably repay.

Interest Rate

The interest rate, also known as the Annual Percentage Rate (APR), is the cost of borrowing money on your credit card. It is expressed as a percentage and represents the annualized rate of interest applied to any unpaid balances. When you carry a balance on your credit card, you will be charged interest on that balance, increasing the overall amount you owe. Understanding the interest rate on your credit card is essential, as it can significantly impact the total cost of your debt if you carry a balance from month to month.

Minimum Payment

The minimum payment is the smallest amount you must pay each month to keep your credit card account in good standing. It is typically a percentage of your outstanding balance, usually around 1-3% of the total amount owed. While making the minimum payment ensures you avoid late fees and penalties, it is important to note that paying only the minimum prolongs the time it takes to pay off your debt and may increase the interest charges. To avoid unnecessary interest, it is advisable to pay off your balance in full each month.

Annual Fee

Some credit cards charge an annual fee for the privilege of owning the card. This fee can range from a nominal amount to several hundred dollars, depending on the card and the associated benefits. Annual fees are common for credit cards that offer premium rewards or exclusive perks. Before choosing a credit card with an annual fee, it is essential to evaluate whether the benefits outweigh the cost. For individuals who do not plan to utilize the card’s features extensively, a no-annual-fee card may be a more suitable option.

Key Factors to Consider Before Applying for a Credit Card

Financial Stability

Before applying for a credit card, it is important to assess your financial stability. Take a close look at your income, expenses, and existing debts to determine if you can comfortably afford to make monthly credit card payments. Consider your ability to manage additional credit responsibly and whether you have a solid emergency savings fund to cover unexpected expenses. Applying for a credit card without adequate financial stability can result in accumulating debt that becomes difficult to repay and may negatively impact your credit score.

Credit Score

Your credit score is a numerical representation of your creditworthiness. Credit card companies use this score, along with other factors, to determine whether you qualify for a credit card and what interest rate you will be offered. A higher credit score generally leads to better credit card options and lower interest rates. Before applying for a credit card, it is advisable to check your credit score and understand the factors that influence it. Building a good credit score takes time and responsible credit use, so it is essential to start off on the right foot.

Credit Card Fees

In addition to annual fees, credit cards may have other fees associated with various actions or transactions. Common fees include balance transfer fees, cash advance fees, foreign transaction fees, and late payment fees. Carefully review the fee schedule for each credit card you are considering to understand the potential costs associated with using the card. While fees can be unavoidable in certain situations, it is always beneficial to choose a credit card with reasonable fee structures and to avoid unnecessary fees through responsible card management.

How to Choose the Right Credit Card

Identify Your Needs

To choose the right credit card, it is essential to identify your needs and priorities. Consider your spending habits and lifestyle to determine what features would benefit you the most. For example, if you frequently travel, a credit card that offers travel rewards or airline miles may be a good fit. On the other hand, if you primarily use your credit card for everyday purchases, a cashback card with rewards on groceries, gas, or dining may be more suitable. Make a list of the features and benefits that align with your needs and use it as a guide during the selection process.

Compare Credit Card Offers

To make an informed decision, compare the offers of different credit card companies. Look for cards that offer competitive interest rates, rewards programs that align with your preferences, and low or no annual fees. Consider additional perks such as travel insurance, extended warranties, or purchase protection. Take note of any introductory offers, such as sign-up bonuses or promotional interest rates, and evaluate the long-term value of the card beyond the initial benefits. Utilize online comparison tools, read customer reviews, and consult with friends or family who have experience with credit cards to gather as much information as possible.

Read the Fine Print

Before applying for a credit card, it is crucial to thoroughly read and understand the terms and conditions. Pay close attention to details such as the interest rate, fees, grace period, and the penalty for late payments or going over your credit limit. Take note of any restrictions or limitations on rewards or perks, as well as any potential changes the credit card company may make to these benefits in the future. By reading the fine print, you will have a clear understanding of what you are agreeing to and can avoid surprises or misunderstandings down the line.

How to Apply for a Credit Card

Research Different Credit Card Companies

Start by researching different credit card companies to find the ones that offer the features and benefits you are looking for. Visit their websites or use online comparison tools to gather information on their credit card offerings. Consider factors such as interest rates, rewards programs, annual fees, and customer service ratings. Narrow down your options to a few credit card companies that best fit your needs and preferences.

Gather Required Documents

To complete a credit card application, you will typically need to provide certain documents and information. These may include your social security number, proof of income, employment details, and current financial obligations. Prepare these documents in advance to streamline the application process. Ensure that the information you provide is accurate and up to date.

Fill Out the Application

Once you have chosen the credit card company and gathered the required documents, you are ready to fill out the application. Most credit card companies offer both online and paper applications. Online applications are usually faster and more convenient, allowing you to complete the process from the comfort of your own home. Follow the instructions provided and provide accurate information to the best of your knowledge. Review the application before submitting it to ensure that all details are correct.

Understanding Credit Card Fees and Charges

Annual Fee

An annual fee is a charge imposed by some credit card companies for the privilege of owning a specific credit card. This fee is typically billed once a year and can range from a few dollars to several hundred dollars. While annual fees can provide access to premium benefits and rewards, it is important to assess whether the value of these benefits outweighs the cost of the fee. Some credit card companies offer fee waivers for the first year, promotional periods, or cards without annual fees.

Interest Charges

When you carry a balance on your credit card, interest charges apply to the outstanding amount. The interest rate, expressed as an APR, determines the cost of borrowing on your credit card. Interest charges are added to your balance each billing cycle if not paid in full. To avoid paying unnecessary interest, it is advisable to pay off your balance in full by the due date. Interest charges can significantly increase the overall cost of your purchases if you consistently carry a balance. Understanding the interest rate and its impact on your debt is essential for responsible credit card use.

Late Payment Fee

A late payment fee is charged when you do not make your credit card payment by the due date. The specific fee amount can vary between credit card companies but is often around $25 to $40. In addition to the late payment fee, late payments may result in higher interest rates, penalties, and a negative impact on your credit score. To avoid late payment fees, it is important to make your credit card payments on time. Set up automatic payments, reminders, or regular check-ins to ensure you stay on track with your credit card obligations.

Foreign Transaction Fee

When you make purchases in a foreign currency or with a foreign merchant, some credit cards may charge a foreign transaction fee. This fee, typically around 3% of the transaction amount, covers the costs associated with currency conversion and international transaction processing. If you frequently travel abroad or make online purchases from international vendors, it is worth considering a credit card with no foreign transaction fees to avoid unnecessary charges. Some credit card companies specialize in travel rewards and cater to international travelers by waiving foreign transaction fees.

Tips for Responsible Credit Card Use

Pay Your Balance in Full and on Time

To maintain a healthy credit card account and avoid unnecessary interest charges, it is crucial to pay your balance in full and on time each month. By paying your balance in full, you avoid carrying debt from month to month and accruing interest charges. Setting up automatic payments or reminders can help ensure that you do not miss a payment. Paying your balance on time is essential to avoid late payment fees and protect your credit score.

Monitor Your Spending

Keeping a close eye on your credit card spending is important for maintaining control of your finances. Regularly review your credit card statements to track your purchases and detect any unauthorized transactions. Monitoring your spending allows you to stay within your budget and identify any areas where you may need to make adjustments. Various tools and mobile apps are available to help you track your spending and manage your credit card accounts effectively.

Avoid Carrying a Balance

Carrying a balance on your credit card means accumulating debt and paying interest charges. To avoid unnecessary interest and maintain a healthy financial outlook, it is advisable to avoid carrying a balance whenever possible. Instead, strive to pay off your credit card balance in full each month. If you are unable to pay the full balance, aim to pay more than the minimum payment to reduce the interest charges and pay off the debt as quickly as possible. Remember, responsible credit card use means borrowing only what you can afford to repay.

How to Read Your Credit Card Statement

Balance Summary

The balance summary section of your credit card statement provides an overview of your current balance, including the total amount owed and any available credit. It will typically indicate the statement period, the statement closing date, the new balance, and the minimum payment due. This summary allows you to quickly assess your credit card account’s financial status and serves as a starting point for further examination of your statement details.

Transaction History

The transaction history section lists all the purchases, payments, and other activities that occurred within the statement period. Each transaction includes the date, the merchant or payee, the amount, and the transaction type. Review this section carefully to ensure that all transactions are legitimate and accurate. If you notice any discrepancies or unauthorized charges, it is crucial to contact your credit card company immediately.

Payment Due Date

The payment due date is the deadline for making your credit card payment without incurring late fees or other penalties. It is essential to note this date and ensure that your payment is initiated well in advance to allow for processing time. Late payments can also have a negative impact on your credit score, so be sure to make your payment before or on the due date specified on your statement.

What to Do If You Can’t Pay Your Credit Card Bill

Contact Your Credit Card Company

If you find yourself unable to pay your credit card bill, it is important to reach out to your credit card company as soon as possible. Explain your situation honestly and inquire about any available options or assistance programs. Credit card companies may be willing to work with you to establish a repayment plan or adjust your payment due date temporarily. Keeping the lines of communication open can help avoid further penalties or negative impacts on your credit score.

Negotiate Payment Options

In some cases, you may be able to negotiate payment options with your credit card company to alleviate your financial burden. This can include requesting a lower interest rate, reducing or eliminating fees, or extending the repayment period. Explain your circumstances and why you are experiencing difficulty in meeting your obligations. It is worth noting that while some credit card companies may be willing to negotiate, it is not guaranteed, and it may depend on factors such as your payment history and overall creditworthiness.

Seek Financial Assistance

If you are facing significant financial hardship that extends beyond credit card debt, seeking professional financial assistance may be necessary. Consult with a credit counseling agency or a financial advisor who can help you create a comprehensive plan to manage your debts and improve your financial situation. These experts can provide guidance on budgeting, debt consolidation, negotiation with creditors, and long-term financial planning.

In conclusion, understanding credit cards is essential for anyone seeking to build a strong financial foundation and make the most of the benefits they offer. By familiarizing yourself with credit card terms, considering key factors before applying, and adopting responsible credit card practices, you can navigate the world of credit cards effectively. Remember to choose a credit card that aligns with your needs, read the fine print, and use your credit card wisely to build a positive credit history and achieve your financial goals.