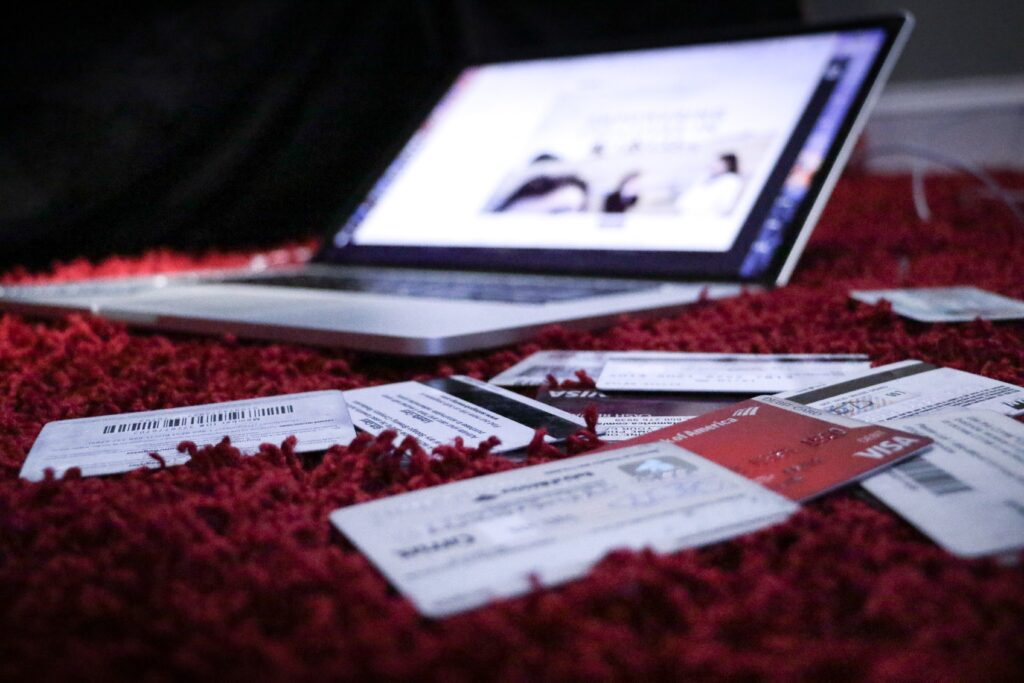

Are you feeling overwhelmed by credit card debt? If so, you’re not alone. Many people struggle with managing their credit card balances, but there are effective ways to tackle this debt and regain control of your finances. In this article, you will discover strategies that can help you pay down your credit card debt faster. By implementing these tactics, you’ll be on your way to financial freedom and peace of mind. So let’s explore these effective methods together and start your journey towards a debt-free future.

Effective Ways to Pay Down Credit Card Debt

1. Create a Budget and Track Your Expenses

1.1 Determine your income and expenses

To effectively pay down your credit card debt, the first step is to create a comprehensive budget. Take the time to determine your monthly income and track your expenses. This will give you a clear picture of where your money is going and help identify areas where you can make adjustments.

1.2 Identify areas where you can cut back on spending

After analyzing your expenses, pinpoint areas where you can cut back on unnecessary spending. This might involve reducing dining out or entertainment expenses, finding more affordable alternatives for certain products or services, or even downsizing certain aspects of your lifestyle. By making these small changes, you can allocate more money towards paying off your credit card debt.

1.3 Set realistic goals for paying down your credit card debt

Setting achievable goals is crucial when it comes to paying down credit card debt. Break down your overall debt into smaller milestones that you can work towards. Celebrate each achievement along the way to stay motivated. By setting realistic goals, you will feel a sense of progress and accomplishment as you gradually pay off your credit card balances.

2. Prioritize Your Debts

2.1 List all your credit card debts

Create a detailed list of all your credit card debts. Include the outstanding balance, interest rates, and minimum monthly payments. This will allow you to have a clear overview of your debt situation and help you prioritize which debts to focus on first.

2.2 Analyze interest rates and minimum payments

Once you have listed all your credit card debts, analyze the interest rates associated with each card. Higher interest rates typically mean higher costs for carrying the debt. Additionally, examine the minimum monthly payments required for each card. This information will help you determine which debts to tackle first.

2.3 Decide on a debt repayment strategy

There are two popular strategies for paying down credit card debt: the snowball method and the avalanche method.

4.1 Understand the snowball method

The snowball method involves paying off your debts from smallest to largest balance, regardless of interest rates. By focusing on the smallest balance first, you can gain momentum and motivation as you see progress quickly. Once the smallest debt is paid off, move on to the next smallest debt, rolling over the amount you were paying towards the previous debt.

4.2 Understand the avalanche method

The avalanche method, on the other hand, prioritizes paying off debts with the highest interest rates first, regardless of the balance. By targeting the debts with the highest interest rates, you can save on interest payments in the long run and pay off your debts more efficiently.

4.3 Choose the method that suits your financial situation

Decide which method aligns better with your financial situation and personal preferences. The snowball method may be more suitable if you prioritize quick wins and the psychological boost of seeing debts disappear. Alternatively, if saving on interest payments is your primary goal, the avalanche method might be a better choice. Select the method that will best serve your needs as you work towards becoming debt-free.

3. Consider a Balance Transfer

3.1 Understand how balance transfers work

A balance transfer involves moving your credit card debt from one card to another with a lower interest rate. This can potentially save you money on interest payments and help you pay down your debt faster. It’s essential to understand the terms and conditions of the balance transfer offer, including any fees or promotional periods.

3.2 Research and compare balance transfer offers

Before making a decision, research and compare different balance transfer offers from various credit card companies. Look for a card with a low or 0% introductory interest rate and a reasonable balance transfer fee, if any. Consider the length of the promotional period, as this will determine how long you have to pay off the transferred balance interest-free.

3.3 Calculate the potential savings and fees

Calculate the potential savings and fees associated with a balance transfer. Take into account the interest savings from the promotional period and any transfer fees. Ensure that the overall cost of transferring your debt is less than the potential interest savings to make it a worthwhile strategy.

4. Snowball or Avalanche Method

4.1 Understand the snowball method

As mentioned earlier, the snowball method involves paying off debts from smallest to largest balance. This approach focuses on creating momentum and motivation by quickly eliminating smaller debts. By tackling small balances first, you gain a sense of accomplishment and can roll over the payments towards larger debts.

4.2 Understand the avalanche method

The avalanche method prioritizes paying off debts with the highest interest rates first. By targeting high-interest debts, you minimize the overall interest you pay and save money in the long run. While it may take longer to see significant progress, this method is optimal for individuals who are primarily motivated by financial savings.

4.3 Choose the method that suits your financial situation

Evaluate your financial situation and personal preferences to choose the debt repayment strategy that suits you best. If you thrive on quick wins and psychological rewards, the snowball method may be the way to go. On the other hand, if you are motivated by long-term savings and are willing to prioritize higher interest debts, the avalanche method may be a better fit.

5. Increase Your Income

5.1 Seek additional employment or freelance work

To expedite your debt repayment journey, consider seeking additional employment or freelance work. Take advantage of the gig economy opportunities available to you. By increasing your income, you can allocate more money towards paying off your credit card debt and accelerate your progress.

5.2 Start a side business or gig

If you have a particular skill or passion, consider starting a side business or gig. Monetize your talents and hobbies to generate extra income that can be put towards debt repayment. Whether it’s selling handmade crafts, offering consulting services, or providing online tutoring, exploring these entrepreneurial avenues can make a significant difference in paying down your credit card debt.

5.3 Utilize your skills for freelance opportunities

Leverage your professional skills by freelancing in your field. Many companies and individuals are seeking specialized talent for short-term projects or assignments. Use platforms like Upwork or Freelancer to find freelance opportunities that align with your expertise. The additional income from freelancing can help you make substantial progress in paying off your credit card debt.

6. Negotiate Lower Interest Rates

6.1 Understand the benefits of negotiating

It’s worth exploring the option of negotiating lower interest rates with your credit card companies. By lowering your interest rates, you can reduce the overall cost of your debt and save money. It’s important to remember that credit card companies have an interest in helping you repay your debts, so they may be willing to work with you.

6.2 Call your credit card companies to negotiate

Contact your credit card companies directly and inquire about the possibility of lowering your interest rates. Be prepared to provide reasons for your request, such as a consistent payment history or a financial hardship. Emphasize your commitment to paying off the debt and explain how a lower interest rate would help expedite the process.

6.3 Consider professional negotiation services

If negotiating with credit card companies seems daunting, consider utilizing the services of professional negotiation companies. These companies specialize in negotiating with creditors on your behalf to secure lower interest rates or reduced payment plans. While there may be associated fees, they can provide expertise and support throughout the negotiation process.

7. Use Cash Windfalls Strategically

7.1 Allocate unexpected or extra money towards debt

When you receive unexpected cash windfalls, such as tax refunds, bonuses, or inheritances, it can be tempting to splurge on discretionary expenses. However, to maximize your debt repayment efforts, allocate these windfalls towards paying down your credit card debt.

7.2 Prioritize high-interest debts with windfalls

When deciding how to distribute the cash windfalls, prioritize paying off high-interest debts first. By tackling the debts with the highest interest rates, you can effectively minimize the additional interest you would accrue over time.

7.3 Avoid splurging and instead put it towards debt repayment

It’s crucial to resist the urge to splurge on non-essential purchases when you receive a cash windfall. While it’s tempting to reward yourself, keep in mind that putting the money towards debt repayment will bring you closer to financial freedom and peace of mind.

8. Cut Expenses and Save

8.1 Analyze your monthly expenses

Take the time to carefully analyze your monthly expenses. Identify areas where you can cut back on discretionary spending, such as dining out, entertainment, or subscription services. Scrutinize your bills and find opportunities to save on essential expenses, such as utilities and insurance.

8.2 Reduce discretionary spending

Reducing discretionary spending is a powerful way to free up additional funds for debt repayment. Consider inexpensive or free alternatives for your entertainment and hobbies. Look for creative ways to cut costs without sacrificing your overall well-being and enjoyment of life.

8.3 Build an emergency fund to avoid future debts

As you cut expenses and save money, it’s important to set aside some funds for emergencies. Building an emergency fund will provide a financial safety net and prevent you from relying on credit cards in case of unforeseen circumstances. By having this safety net, you can avoid accumulating new credit card debt and maintain progress in paying down existing balances.

9. Seek Credit Counseling or Debt Management

9.1 Understand the role of credit counseling agencies

Credit counseling agencies can provide valuable guidance and assistance in creating a realistic plan to pay off your credit card debt. These agencies work with you to review your financial situation, create a budget, and negotiate with creditors on your behalf. Their expertise can help you navigate the complexities of debt management and provide you with a personalized plan for success.

9.2 Find a reputable credit counseling agency

When seeking credit counseling services, it’s essential to find a reputable agency. Research and choose an agency that is accredited by recognized organizations like the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Look for reviews and testimonials to ensure the agency has a positive track record.

9.3 Explore debt management programs

Credit counseling agencies may also provide access to debt management programs (DMPs). These programs consolidate your debts into a single monthly payment and often come with lower interest rates negotiated by the agency. By enrolling in a debt management program, you can simplify your repayment process and potentially save money on interest payments.

10. Stay Motivated and Seek Support

10.1 Set milestones and celebrate achievements

Paying down credit card debt can be a challenging journey, but it’s important to stay motivated and celebrate your achievements along the way. Set achievable milestones that mark your progress and reward yourself when you reach them. Whether it’s treating yourself to a small indulgence or celebrating with loved ones, acknowledging your accomplishments will keep you motivated and focused.

10.2 Seek support from friends, family, or support groups

Building a support system is crucial when overcoming any challenge, including debt repayment. Share your goals and progress with trusted friends or family members who can provide encouragement and accountability. Consider joining online forums or support groups where you can connect with others who are on a similar journey. Seeking support will remind you that you are not alone and that others have conquered debt successfully.

10.3 Stay determined and focused on your debt repayment journey

Lastly, remember to stay determined and focused on your debt repayment journey. It may take time and effort, but by consistently following your budget, prioritizing your debts, and utilizing the strategies mentioned above, you can find yourself on the path to financial freedom. Keep your long-term goals in mind and remind yourself of the benefits and peace of mind that come with being debt-free.

Incorporating these strategies into your financial plan can make a significant difference in paying down your credit card debt. Remember, progress may be gradual, but with consistency and dedication, you can ultimately achieve your goal of becoming debt-free.